HOME EQUITY LOANS FROM AIM CREDIT UNION

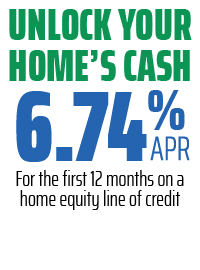

FEATURING 6.74% FOR 12 MONTHS ON HOME EQUITY LINE OF CREDIT LOANS

Put your home’s equity to work with an AIM home equity loan.

A home equity loan is a perfect option for home improvement projects, debt consolidation, paying tuition expenses or making major purchases.

With home equity loans, the interest you pay may be tax deductible. Consult your tax advisor regarding tax deductibility.

Any advertised closing costs assume title guaranty and appraisal are not required. Additional costs may apply. Rates, terms and conditions subject to change and may vary based on qualifications including creditworthiness, loan-to-value ratio and collateral conditions. Loan-to-value ratio must not exceed 70%. InTENse loans do not include escrow, so you will be responsible for tax and insurance payments. All loans subject to membership and approval. Member NCUA. Equal Housing Lender.

See current loan rates and disclosures